amazon flex driver tax forms

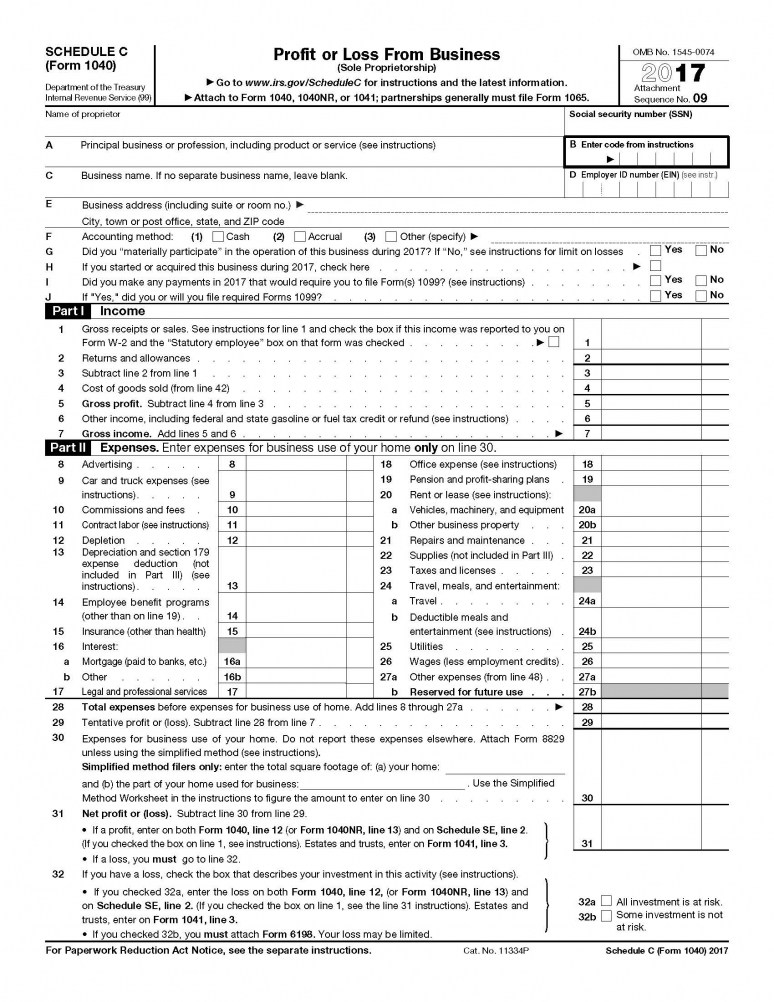

You pay 153 SE tax on 9235 of your Net. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

For drivers who want to know exactly how much they saved in taxes in a given.

. Amazon Flex Business Phone. Gig Economy Masters Course. Service income to US.

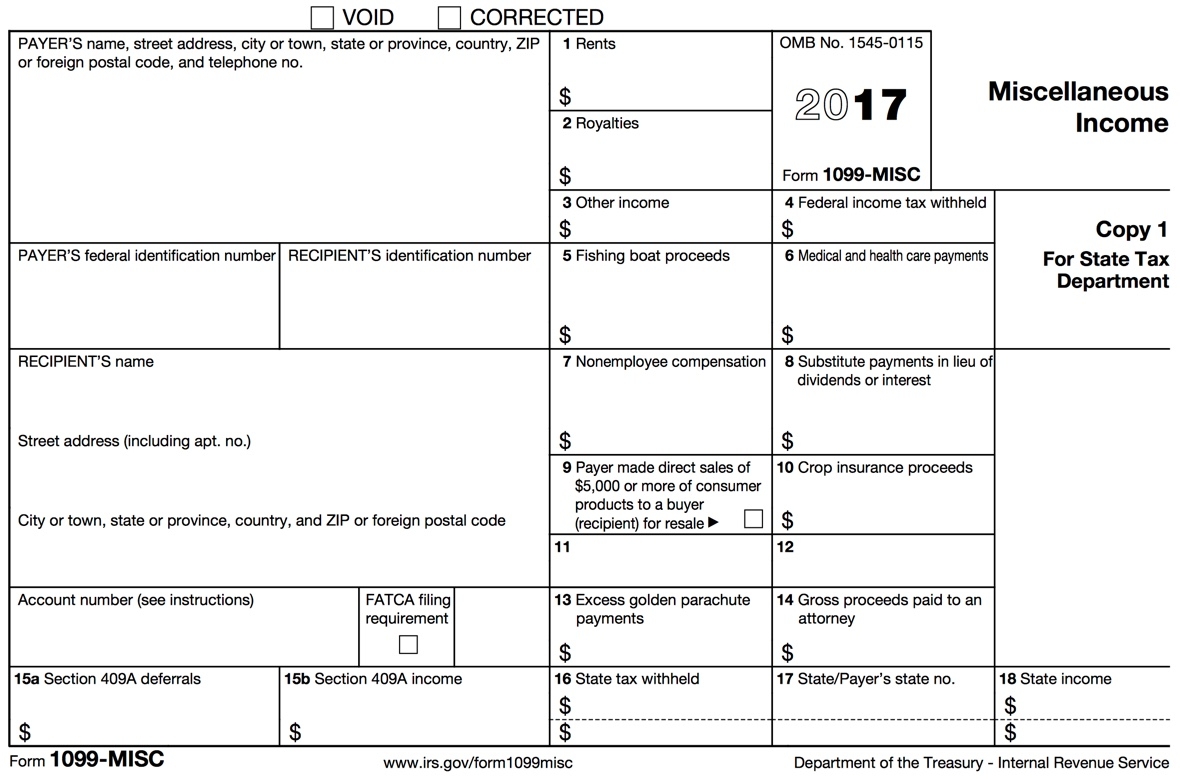

Select Sign in with Amazon. Form 1099-NEC is replacing the use of Form 1099-MISC. This is the non-employee compensation 1099 form you receive from Amazon Flex.

If you still cannot log into the Amazon Flex app. Or download the Amazon Flex app. Be 21 or older.

Amazon Flex drivers will start getting checks for 60 million in withheld tips. Whatever drives you get closer to your goals with Amazon Flex. Amazon Flex delivery auto insurance provides 50000 in vehicle damages.

Op 2 yr. Tap Forgot password and follow the instructions to receive assistance. Knowing your tax write offs can be a good way to keep that income in your pocket.

Youll need to declare your Amazon flex taxes under the rules of HMRC self-assessment. Use a Mileage Deduction Calculator To See How Much You Can Save. Amazon clearly do not verify people properly I have uploaded sufficient information that enables full verification to be made.

We would like to show you a description here but the site wont allow us. There are other situations and this may be what you have where a self-employed person or independent contractor has multiple jobs but the jobs are very similar. Driving for Amazon flex can be a good way to earn supplemental income.

7 2022 and said that drivers who receive more than 600 will receive federal tax. Drivers who had 5 or more illegally taken. If you make under 600 then you dont need to file it for taxes and thats why your not seeing the 1099 form.

Most drivers earn 18-25 an hour. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice. Amazon have asked for more with.

6 rows Amazon Flex Legal Business Name. Actual earnings will depend on your location any tips you receive how long it. Forum for Amazon Flex.

The forms are also sent to the IRS so take note if youve made more than 600. No matter what your goal is Amazon Flex helps you get there. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

With Amazon Flex you work only when you want to. Increase Your Earnings. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Ad We know how valuable your time is. Youll need to submit a tax return online declaring your. This subreddit is for Amazon Flex Delivery.

Tax Returns for Amazon Flex. Here are some of the most frequently-received 1099 forms received by Amazon drivers. We know how valuable your time is.

The FTC just sent 139507 checks totaling 59428878 and 1621 PayPal payments totaling 171715 to Amazon Flex drivers. Sign out of the Amazon Flex app. Form 1099-NEC is used to report nonemployee compensation eg.

With Amazon Flex you work only when you want to. Beyond just mileage or car. As an Amazon Flex delivery driver you qualify for Amazons free commercial car insurance coverage.

Have a valid US. If you are a US. Amazon Flex Mileage Tracking Tip 2.

You can plan your. To be eligible you must. The agency urged affected Amazon Flex drivers to deposit or cash their checks before Jan.

Have a mid-size or larger vehicle.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Dr Maurizio Bragagni Obe Officer British Empire Mba Cdir Fiod British Manufactured And Consumer Goods Advisor Department For International Trade Dit Linkedin

Lost Your 1099 Form What To Do To Avoid Penalties

16 Amazon Flex Driver Tips And Tricks How To Earn More In 2022

What Happens If You Don T File A 1099

16 Amazon Flex Driver Tips And Tricks How To Earn More In 2022

Amazon Flex Background Check What You Must Know Ridester Com

Amazon Flex Background Check What You Must Know Ridester Com

Ab 63 Sb 1146 Tax Discovery Los Angeles Office Of Finance

Tax Tips For Couriers On The Skip Network Youtube

How To Find An On Demand Courier Delivery App

0 95inch 128x64 Oled I2c Display Blue Yellow Ssd1306 Driver

Ab 63 Sb 1146 Tax Discovery Los Angeles Office Of Finance

What Happens If You Don T File A 1099

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Tasmanian Tiger First Responder Move On Mkii Recon Company

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

1099 Write Offs 6 Popular Tax Deductibles For Independent Contractors Moves Financial